Image generated with gpt4o

Image generated with gpt4o

At its heart, pricing is the bridge between the economic value you create and the revenue your business captures. In classical economic theory, price emerges where supply meets demand: it is the signal by which markets allocate scarce resources, balancing what producers are willing to sell for against what consumers are willing to pay. In this view, a product’s “right” price lives at the intersection of its marginal cost (the extra cost of producing one more unit) and the marginal utility (the additional benefit) it delivers to each customer.

Pricing theory has changed a lot in the past decades, for instance, by the mid-20th century, managers had distilled this into three pragmatic approaches:

-

Cost-Plus Pricing

Add a markup to unit cost to achieve a target profit margin. Simple and internally focused, but blind to how customers perceive value or what competitors charge.

-

Competitive (or Market-Based) Pricing

Anchor your price around prevailing market rates. You either match, undercut, or premium-position yourself relative to rivals—yet without necessarily testing whether that number reflects your unique value proposition.

-

Value-Based Pricing

Set price in proportion to the customer’s perceived benefit. Instead of “What does it cost us, plus X%?” you ask “What return will it generate for them, and how much of that can we capture?” Value-based pricing aligns your revenue with the real economic impact you deliver, but requires rigor in measuring willingness-to-pay and segmenting customers by the distinct outcomes they prize.

Beyond those pillars, classic pricing theory also introduces strategic levers such as price skimming (launch high, then gradually cut as competitors enter), penetration pricing (start low to gain share, then increase), and psychological tactics (e.g. “99.99” vs. “100”). Together, these frameworks remind us that setting a price is rarely a one-dimensional cost calculation: it’s a strategic decision that shapes your market position, incentivizes the right customer behaviors, and ultimately determines whether the value you create truly—and sustainably—turns into profit.

Pricing isn’t the sexiest topic in the C-suite. It’s the old-school lever you tweak after the product is shipped and the sales deck is finished—right?. I am afraid that doing then it’s too late.

Writing this article was motivated by me listening two podcasts about pricing at Lenny’s newsletter. One from back to 2022 and the other a few weeks ago in 2025. I also had some time to browse two books from the interviewed Madhavan Ramanujam: “Monetizing Innovation” and its sequel “Scaling Innovation”, much more focused on pricing AI products.

Pricing fundamentals in the SaaS era

SaaS models brought about a new form to see pricing, much linked with the way the service is provided and the value (in operational and financial terms) this delivery model offers. What’s interesting here is that since models were new, with no market references, service prices had to be backed up by value. In these early days the value captured was little, as we will see below due to the dependency of other “human-led” procedures:

-

Price is a measure: Madhavan Ramanujam loves the analogy: Liters measure volume; price measures value. If a liter of water suddenly cured migraines, we’d all pay Perrier prices for tap water by noon.

-

Cost ≠ price: In the on-prem era, vendors cost-plus-priced: BOM (bill of materials, in other words sourcing costs) + margin = list. Cloud/SaaS blew that up. Salesforce could charge $50/user/month for software that cost pennies to deliver because the value of “no hardware + faster releases” was enormous.

-

Willingness-to-pay (WTP): If users say they love your product but balk at a credit-card field, you don’t have product-market fit—you have product-market-pricing fit problems. High WTP is the only real validation.

-

20 % of features → 80 % of WTP: Sadly, those features are usually the easiest to build, so founders throw them into the free plan and spend three years “adding value” nobody wants.

Few decades ago SaaS rewired pricing: subscriptions killed one-off negotiations, the seat became the metric, freemium model (and his evil twin free trial) and usage-based models (such as AWS, Twilio, Snowflake pay-per-use schemes).

Enter AI: why the old playbook breaks

However the AI broke some of the rules established in the past two decades. Since AI isn’t just faster, it’s different, in many case rewiring complete existing processes:

- Attribution jumps – LLM-powered features can tie improvements directly to KPI deltas (e.g., charge-backs recovered, tickets auto-resolved).

- Autonomy rises – When an agent replaces human labor, cost : value ratios 10× overnight.

- Cost curves matter – Inference isn’t free. A token-heavy workflow can eat your gross margin if you stick to $20/seat.

Ramanujam (now promoting his sequel Scaling Innovation) argues AI founders must tackle monetization from day one. His reasoning? If you anchor the market at latte prices, you’ll never climb to champagne value capture later.

Lenny’s podcast “Art & Science of pricing”

The first episode (back to 2022) in Lenny’s podcast talked about the “Art & Science of pricing”, in it Madhavan Ramanujam spent an hour turning decades of consulting war stories into bumper-sticker wisdom. If you want a quick summary, see the table below:

| Insight | Sound-bite |

|---|---|

| Price before product | “You’ll have the pricing conversation with the customer eventually. The only thing you control is when.” |

| WTP interview hacks | Relative framing, “acceptable/expensive/prohibitive” ranges, purchase-probability scales. |

| 20 / 80 rule | 20 % of roadmap drives 80 % of WTP—don’t give it away. |

| Leaders / Fillers / Killers | Bundle design: put leaders in every plan, use fillers to raise AOV, keep killers as paid add-ons. |

| Segmentation = product-isation | Demographics are useless; segment by needs + value + WTP. |

Lenny’s podcast “Pricing AI”

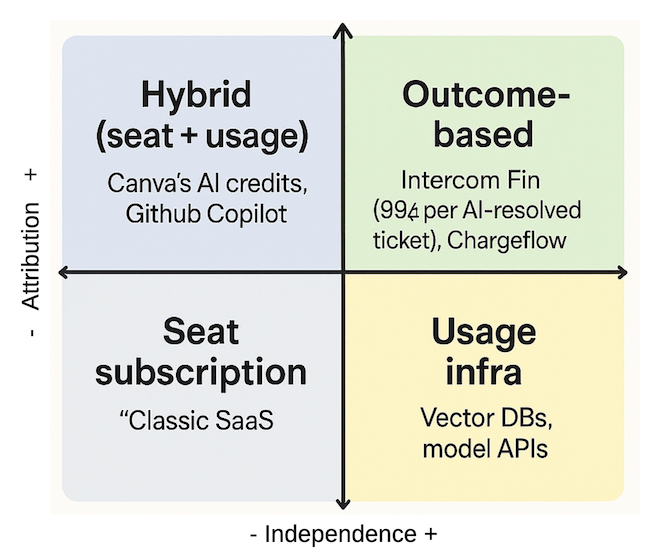

The second episode talked in detail on the pricing AI services. He much went over the “Two-by-two” model, that combines two axis for your AI product attribution (how much value comes from the use of the service) and autonomy (how much the AI-based solution is able to do the job alone). Based on this framework we can have 4 situations:

| Quadrant | Pricing model | Example |

|---|---|---|

| Low attribution, low autonomy | Seat subscription | “Classic SaaS” |

| High attribution, low autonomy | Hybrid (seat + usage) | Canva’s AI credits, GitHub Copilot |

| Low attribution, high autonomy | Usage infra | Vector DBs, model APIs |

| High attribution, high autonomy | Outcome-based | Intercom Fin (99¢ per AI-resolved ticket), Chargeflow (25 % of recovered $) |

Only ~5 % of AI companies sit in the top-right quadrant today, yet they grab 25–50 % of the value they create. Expect that share to climb to 25 % in three years.

On the other hand it explains the very nature of PoC as a test for prove value to the customer. He insists that PoC must be paid, but the price is used to build the business model for the client (while assessing the product attributed value). As usual the best case scenario is the one with the most independence along with the highest (value) attribution.

Two engine: attribution x independence

Two engine: attribution x independence

The episode also covers other questions to bear in mind when launching new ventures:

| Theme | Core takeaway |

|---|---|

| Master both engines (2 by 2) | Great AI startups must capture market-share and wallet-share simultaneously. Ignoring either leads to “single-engine stalls.” |

| Monetize from day 1 | AI unlocks huge, attributable value (e.g., labor savings). If you launch at $20 / seat you’ll anchor customers low and struggle to raise later. |

| The 20 / 80 reality | 20 % of features create 80 % of willingness-to-pay—and that 20 % is usually the easiest to build. Don’t give it away in the free tier. |

| POCs are business-case labs | A proof-of-concept’s sole goal is to co-create an ROI model. Charge for POCs (filters tire-kickers) but make clear it’s not the eventual price. |

| Two-by-two for AI models | • Attribution (can you prove the KPI impact?) vs. Autonomy (is the AI truly hands-off?) |

| – Low/Low ⇒ Classic seat subscription | |

| – High attribution + some human ⇒ Hybrid (seat + usage) | |

| – High autonomy, low attribution ⇒ Usage-based infrastructure | |

| – High/High ⇒ Outcome-based (golden quadrant: charge per AI-resolved ticket, recovered $, etc.) | |

| Pricing-power sweet spot | Only ~5 % of AI startups sit in the outcome quadrant today, yet they capture 25–50 % of delivered value. Expect that share to reach 25 % of startups within 3 years. |

| Negotiation rules | • Always trade gives for gets (e.g., discount ↔ value-audit). |

| • Show 2–3 options; force the discussion onto value, not one price. | |

| • Taper concessions (15 % → 5 % → 2 %) to signal the end. | |

| Price-increase mindset | “Price paralysis” is internal and emotional; revisit price (or metric) at least every 6-12 months in AI, not every 2 years. |

| Six common traps | Land-but-no-expand, nickel-and-diming, price-premium paradox, foundation-but-no-frontier, training users to expect “more for less,” relying on one “engine.” |

| Vision: outcome or bust | To win big, steer roadmap toward high attribution and high autonomy—dashboards that prove impact, agentic workflows that remove humans. |

Land & expand

The land-and-expand strategy is a go-to-market approach where a company initially “lands” a small deal with a customer—often through a low-friction, limited-scope product or team-level adoption—and then gradually “expands” the relationship by increasing usage, selling additional features, or scaling across departments. It’s commonly used in SaaS and enterprise software to reduce barriers to entry and drive long-term revenue growth through customer success and internal virality.

Practical tips for AI founders

Image generated with gpt4o

Image generated with gpt4o

The second episode, more focused on AI, gives some interesting pieces of advice for founders, urging the price-awareness from zero minute:

-

Charge for POCs—smartly: Frame it as a 30-day ROI sprint. Price filters casual browsers; clarify it’s only for the pilot, not the eventual contract.

-

Pick a pricing archetype on day 1: Use the Attribution × Autonomy matrix. If you’re hybrid today, road-map features that lift you to outcome-based pricing.

-

Anchor on value, not effort: Quantify KPI lift (revenue gained, churn cut, hours saved). Aim to capture 25–50 % of that value in price or rev-share.

-

Protect the 20 % that sells: Identify the few capabilities that drive WTP; gate them behind a paid tier. Don’t MVP them away for free.

-

Bundle options, not one quote: Present Good–Better–Best or Flat + Outcome. Options pivot the conversation to benefits and deter price haggling.

-

Draft a “give–get” playbook: Every concession (discount, payment terms) demands a reciprocal get: multi-year term, case study rights, internal value audit.

-

Review price structure every 6 months: In AI the cost curve and customer ROI change fast; treat metric tweaks and uplift campaigns as a routine sprint.

-

Design for attribution: Ship in-product dashboards that tie usage to dollars saved/earned. Attribution unlocks the top-right quadrant.

-

Expand intentionally: Land with essential workflow; upsell via usage thresholds, outcome shares, or adjacent AI agents—keep a clear fence.

-

Measure both engines weekly: Track logos added and net-revenue-retained. If one lags, deploy the matching strategy from the book’s nine-part toolkit.

Founders’ cheat sheet

Just to wrap the two episodes up, take this cheat sheet:

Start with willingness-to-pay

-

Draft three value stories (pain removed, gain unlocked, dream enabled).

-

Run 12–20 WTP conversations before a single line of prod code ships. Use the “acceptable / expensive / prohibitive” ladder.

-

Prioritise roadmap brutally – Anything that doesn’t move the WTP needle stays in Jira purgatory.

Pick the right metric, not just the price

Use Ramanujam’s AI matrix:

-

Copilot? → Seat (+ maybe AI credits).

-

Agent but hard to tie to KPI? → Usage.

-

Agent and crystalline attribution? → Outcome share.

Design the land-and-expand rails

| Stage | Tactics |

|---|---|

| Land | Simple plan, immediate “aha moment” low commit. Charge enough to qualify serious customers (paid pilot > free POC). |

| Product fences | Gate by value drivers— seats, monthly tracked users, AI credits, whatever maps to cost & value. |

| Expand | Usage thresholds, outcome escalators, adjacent agents. Leave obvious headroom. |

Bundle like a pro

- Leader must-have core (drives conversion).

- Filler nice-to-have (lifts ARPU).

- Killer niche delight (sold à-la-carte).

Negotiate with give-get discipline

-

Never grant a concession un-reciprocated.

-

Show options: 400 K all-in. Amazing how often the “too-high” anchor closes.

-

Ask for value audits at 6-month marks; priceless ammo for renewals.

Raise prices every 6–12 months

Keep in mind the two points of view:

- Internally: rehearse the story (cost inflation, more autonomy, proven KPI lift).

- Externally: two-tier announcement email— CFO-friendly logic up top, “what this means for you” calculator below.

Churn-proof by acquiring the right customers

Dig cohort data:

- Who hits payback fastest?

- Who buys add-ons?

- Who renews without a discount?

Common traps in your AI strategy

It’s nice that you reached this point in the post. It’s right time to put on the table some questions to prevent anything spoils you pricing strategy:

| Trap | Symptom | Antidote |

|---|---|---|

| Land-but-no-expand | 5-figure pilots, flat NRR | Hold back key capabilities; usage fences. |

| Nickel-and-diming | Customer Slack channel full of “why extra fee?” | Bundle fillers; kill hidden surcharges. |

| Price-premium paradox | ASP high, win-rate low | Add lower-commit entry with self-serve upgrade path. |

| Foundation-but-no-frontier | Cult-like niche, no TAM growth | Adjacent use-case packaging; partner channels. |

| “More for less” conditioning | Every renewal demands discount | Instituted value audits; switch to outcome metric. |

| Cost-explosion | Inference bills > revenue | Token-efficient prompts, batching, retrieval cache— then reprice. |

What are these traps about?

See below a more concise definition of each of the traps mentioned:

- Land-but-no-expand: You successfully land initial customers—often via pilots or low-tier plans—but fail to grow the account over time. Expansion revenue is flat, and Net Revenue Retention (NRR) stagnates.

- Nickel-and-diming: Every small feature, support request, or capability comes with an extra fee—creating friction, mistrust, and purchase anxiety.

- The price-premium paradox: You position yourself as a premium product, but you’re losing deals due to price sensitivity or lack of clear differentiation.

- Foundation-but-no-frontier: You’ve built a solid initial product—everyone loves the MVP—but there’s no clear next step. TAM is smaller than you thought, and growth stalls.

- “More for less” conditioning: You’ve trained your customers to expect more features, more support, more usage—for the same or lower price, every year.

- _Cost explosion: Your infrastructure, compute, or AI inference costs scale faster than revenue—eroding gross margin and making growth unsustainable